The Middle East and North Africa region consumes approximately 14 million MT of various oils and fats. The consumption of oils and fats in the Middle East and North Africa differs significantly with most of the growth recorded in North Africa. In term of per capita consumption, the region has considerably high per capita consumption of over 20kg in most countries. Yemen, Sudan, Somalia, Ethiopia and Eritrea are among the countries with per capita consumption of below 10kg.

MENA : Oils and Fats Consumption (‘000 MT)

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 5-Year CAGR | |

|---|---|---|---|---|---|---|---|

| Middle East | 7,565.4 | ,7608.3 | 7,730.9 | 7,905.7 | 8,106.6 | 8,136.9 | 1.47% |

| North Africa | 5,058.1 | 5,261.7 | 5333.7 | 5582.1 | 5760.8 | 5952.2 | 22.74% |

| Total Consumption | 12,624 | 12,870 | 13,065 | 13,488 | 13,867 | 14,089 | 2.22% |

Source: Oil World

Palm oil, sunflower oil and soybean oil constitute 30%, 25% and 23% of the total oils and fat consumption in the region respectively. The region is heavily dependent on imports to supplement domestic requirement of oils and fats and it accounted for 72% of the region’s oils and fats requirement. The region is dependent on imports due to lack of suitable agriculture land, non-conducive geographical landscape and harsh weather condition.

Out of the total oils and fats imported by the region in 2019, palm oil command 47% of that. It is mostly use in the frying industry, margarine and vanaspati manufacturing, as well as the fat ingredients of bakery and confectionery products. Palm oil imports have grown marginally by about 2% in the last 5 years.

MENA – Palm Oil Consumption and Imports (‘000 MT)

| 2015 | 2016 | 2017 | 2018 | 2019 | 5-Year CAGR | |

|---|---|---|---|---|---|---|

| Palm Oil Consumption (‘000 MT) | 3,881.1 | 3,918.9 | 3,883.6 | 4,024.8 | 4,196 | 1.23% |

| Palm Oil Import | 4,353 | 4,296 | 4,753 | 4,884 | 4,806 | 2.00% |

Source: Oil World

Exclude Djibouti Import

Malaysian palm oil position

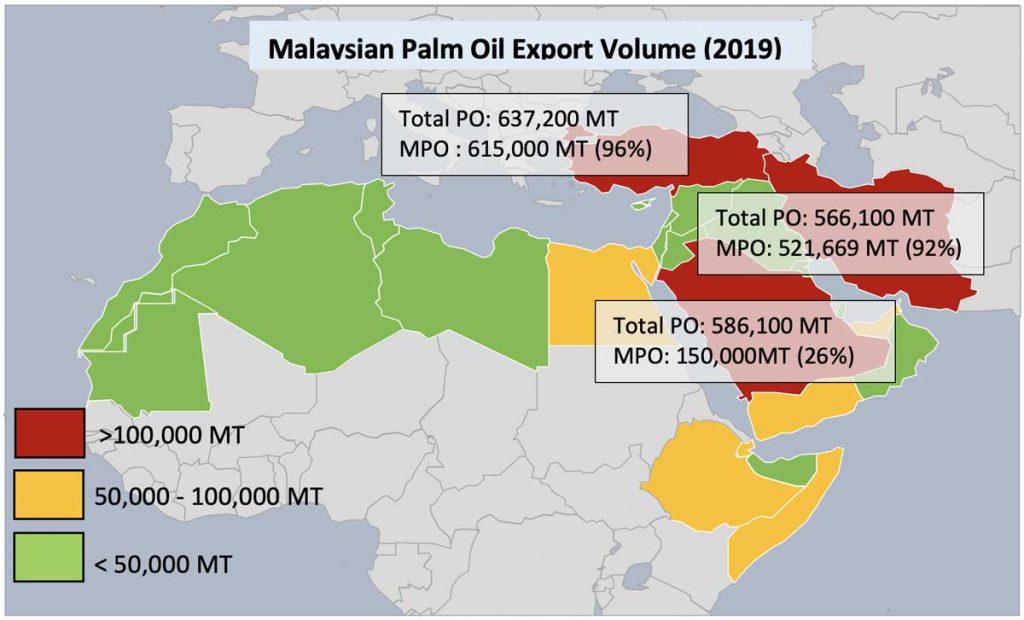

Malaysia exported about 2 million MT of palm oil into the region in 2019. Currently, Turkey, Iran and Saudi Arabia are the leading importers of Malaysian palm oil in the region. These three markets account for 68.79% of the total Malaysian palm oil in the region. The signing of FTA between Malaysian and Turkey in 2015 contributed to the rise of Malaysian palm oil in the market. Malaysian currently dominates the Turkey palm oil market with the share of 96%. Malaysian palm oil also dominates Iran market with share of 92%. However, despite being one of the top Malaysian palm oil export destinations in the region, Malaysian palm oil share in Saudi Arabia market is only at 26%.

Somalia, Egypt, UAE, Ethiopia, Yemen and Djibouti imported between 50,000 MT – 100,000 MT of Malaysian palm oil. Egypt was once importing over 200,000 MT of Malaysian palm oil but due to stiff competition with Indonesia, Malaysian palm oil has slowly eroded and the market share is currently standing at only 3%. Ethiopia market was very promising 3 years ago but their lack of foreign exchange earning has distorted the market growth.

Djibouti, is the entry point for land-locked Ethiopia and serve as the processing hub for the market. Imports through this market is very much dependent on Ethiopian demand and spending on oils and fats. For the rest of the market, their appetite for palm oil are very much dependent on their economic progress which dictates their ability to import Malaysian palm oil.

A strong presence of big companies such as Wilmar and Pacific Interlink (PIL), provide greater opportunities for Indonesian palm oil especially when these companies are having highly integrated supply chain which contribute to their greater efficiency and competitiveness. These markets should be able to absorb more Malaysian palm due to its sizeable population and lower per capita consumption of less than 10kgs (Ethiopia, Somalia and Yemen).

MENA: 50,000 MT – 100,000 MT Malaysian palm oil Markets (2019)

| 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|

| Somalia | 61,306 | 80,381 | 82,322 | 77,929 | 93,456 |

| Egypt | 209,524 | 151,649 | 191,612 | 67,338 | 84,950 |

| UAE | 76,805 | 66,055 | 83,774 | 56,530 | 75,621 |

| Ethiopia | 94,050 | 136,232 | 173,591 | 148,647 | 64,757 |

| Yemen | 88,031 | 35,501 | 74,206 | 97,055 | 64,255 |

| Djibouti | 54,764 | 80,213 | 137,995 | 216,190 | 52,316 |

Source: MPOB

Most of the market in the region imports less than 50,000 MT of Malaysian palm oil. Their small population and political instability limits Malaysian palm oil volume going into the market besides their inclination towards other soft oils such as sunflower, soybean and olives oils which traditionally use in their food preparation.

MENA: < 50,000 MT Malaysian Palm Oil Markets (2019)

| 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|

| Algeria | 31,292 | 32,101 | 29,976 | 28,922 | 34,661 |

| Qatar | 4,281 | 7,157 | 16,852 | 23,444 | 28,693 |

| Kuwait | 29,065 | 24,422 | 28,881 | 30,628 | 27,994 |

| Oman | 19,439 | 8,000 | 38,443 | 83,136 | 26,170 |

| Syria | 15,986 | 8,224 | 10,748 | 40,448 | 18,299 |

| Jordan | 30,543 | 33,595 | 21,885 | 16,567 | 14,153 |

| Bahrain | 7,692 | 9,181 | 11,739 | 13,612 | 12,633 |

| Iraq | 7,602 | 12,229 | 14,669 | 16,511 | 11,468 |

| Lebanon | 9,460 | 8,254 | 10,195 | 9,558 | 7,929 |

| Sudan | 5,377 | 3,422 | 14,647 | 4,359 | 7,457 |

| Eritrea | 4,816 | 7,512 | 9,563 | 5,940 | 4,936 |

| Morocco | 22,069 | 25,106 | 16,685 | 22,057 | 2,434 |

| Libya | 73 | 413 | 148 | 399 | 682 |

| Tunisia | 15,452 | 10,436 | 9,841 | 130 | 535 |

| Palestine | 62 | 23 | 87 | 215 | 283 |

Source: MPOB

Malaysian Palm Oil Expansion Plan

MENA Region imports close to 5 million MT of palm oil of which 2 million or 42% is of Malaysian origin. To maintain Malaysian palm oil market share is indeed very challenging more so to expand into the market. However, the followings could be the ways to secure Malaysian palm oil interest in the region.

Establishing Storage Facility

Having a storage facility in market such as Egypt could be our way forward. It could be our proactive measure to supply to the market efficiently and cater to a small demand competitive. Egypt is a very big market importing close to I million MT of palm oil beside able to be the Malaysian palm oil distribution centre supplying to the Northwest markets with considerable low import of Malaysian palm oil.

It could be way of managing Malaysian palm oil stock level where some stock could be moved to the region creating price stabilizer for Malaysian palm oil.

Counter-Trade and Barter Trade

Counter Trade is one of the way to secure palm oil export into the market. Several counter-trades took place previously and among them were between Malaysian palm oil and India and rail track constructions

Similar arrangement could be considered to enhance Malaysian palm oil trade into the region while benefiting from the region’s expertise in specific areas which Malaysia is lacking.

Beside counter trade, barter trade could also be considered as another way of exchanging palm with products coming out of MENA region. For example:-

Palm Oil with Ethiopian Coffee

One of the item could be traded with palm oil is Ethiopian coffee. Ethiopia is one of the largest coffee producers, exporting 200 million Mt of coffee beans with value of USD900 million. Malaysia may consider importing coffee from Ethiopia in exchange with palm oil. It is estimated that Malaysia imported US$270 million worth of coffee in 2019. If the value translates into palm oil volume (@RM2500/MT) it is at least 100,000 MT of refined palm olein.

Palm Oil with Sudan’s Livestock

Malaysia is a net importers of animal products and mainly source the supply from New Zealand, Australia and India. Animal products imports were valued at more than USD 1 billion (2018) and Malaysia may consider sourcing from Sudan for our future animal products supply to supplement domestic requirements of animal products which grow at 7% (based on study by UPM Veterinary Faculty, 2015)

Conclusion

MENA is the market where palm oil could further develop as future Malaysian palm oil market. In term of oils and fats imports share, it only accounted for 18% or 2 million MT of the total oils and fats import by the region. The volume could further expand particularly in those markets with lower per capita consumption.

If Malaysian palm oil could activate some of the trade arrangements that benefits both countries, Malaysian palm oil could find new home and withstand the challenges imposed by the current traditional markets.

Prepared by Fatimah Zaharah

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.